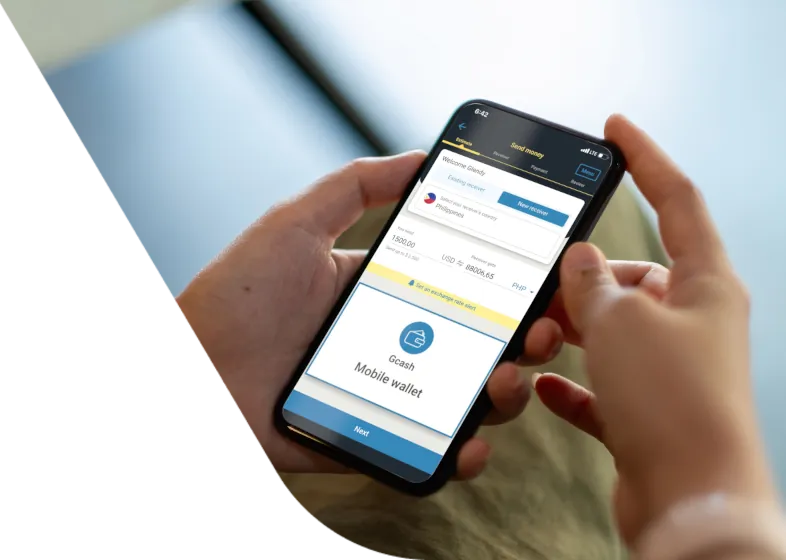

GCash is a secure and convenient way for your family and friends to access funds quickly. You can send up to 5k PHP to mobile wallets!

Convenient ways to send and receive money

Ways to send money to the Philippines

Ways to receive money in the Philippines

Send online

Log in or register for a free profile to quickly transfer money to the Philippines online.

Make an online transferSend with our app

Transferring money on the go is straightforward with the Western Union app. Start a remittance to the Philippines on your phone and finish in-store.

Get the appSend in person

Visit your nearest Western Union agent location to make a transfer in person.

Search our US locationsMobile wallet

With mobile wallets, sending money is easier and faster than ever before, including GCash, Maya, and many more.

Start a transferBank account

Transfer money to bank accounts in the Philippines directly. We work with big names including Banco de Oro, Bank of the Philippine Islands and the Philippine National Bank.

Learn moreCash pickup

With more than 21,0001 agent locations across the Philippines, your loved ones can choose their local spot when collecting their money. No more receiver charges8 on cash pick-ups.

Find an agent locationDebit Card

Send money to debit cards of relatives and friends, 24/7 using their Visa debit card number.

Send money online

Send money to our network in the Philippines

For 150 years, Western Union has been a leading global provider of fast and easy money transfers. Use our extensive network of payment service providers in the Philippines for seamless transactions. Whether to wallets, bank accounts, or for cash pickup, enjoy reliable payouts.

Our featured payout partners in the Philippines include GCash, LBC, BDO Unibank, BPI, Metrobank, Philippine National Bank, Land Bank of the Philippines, Union Bank and Maya.

We also partner with many other trusted institutions, such as GoTyme Bank, RCBC, Security Bank, Philippine Savings Bank, China Bank, East West Bank, BDO Network Bank, SeaBank Philippines. You can also find multiple cash pickup locations here.

Choose the way you pay

Using your bank details

Cash at an agent location

With a credit2 or debit card

Earn points with Western Union Rewards every time you send money

Points on every transfer

Earn 250 points when you complete your profile and 100 points with every completed transaction.

Redeem points for discounts

Use points for savings on your transfer fees on our app or website once you reach 500 points.

Member-only offers

Get exclusive deals, personazlied offers, and perks, just for being a member.

Easy tracking

Keep tabs on your points and benefits in the app or online.

More information on how to send money to the Philippines from the US

Transfer money to major banks in the Philippines

Send funds to the likes of BDO Unibank, Metropolitan Bank & Trust Company and Land Bank in the Philippines.

Pay for prepaid mobile phone minutes

When sending money to the Philippines, why not buy prepaid minutes for your family members through Globe and ensure you stay connected.

Quickly send funds home

Your money should reach your friend or relative in minutes3 with cash pickup, or up to one banking day.

Reasons to choose Western Union®

More control over your transfers

Send money online to the Philippines or download our helpful app. You can also complete a transfer in person from a Western Union agent location.

Focused on security

Encryption and fraud prevention efforts are at the heart of any money transfer to the Philippines.

Convenient locations

With thousands of agent locations around the US, you shouldn’t have far to travel when you want to send money to the Philippines in person.

A global outlook

Our reach stretches far beyond the Philippines, as we serve more than 200 countries and territories.

Sign up to send money to the Philippines today

Jargon-free process

With our quick registration process, you can begin sending money to the Philippines in minutes for cash pickup3.

Send money again and again

Save your loved ones’ details to speed up future remittance to the Philippines.

Keep an eye on your transfers

Track your funds all the way from the US to the Philippines.

Frequently asked questions

How do I send money from the US to the Philippines?

You’ll have a wealth of choices when researching how to send money to the Philippines. Whether supporting relatives in your hometown or transferring funds as a gift, the main options to send money are:

- Online. Just register for a profile to get started.

- Via our app. Another quick and easy way to move money.

- In-person. Find an agent location close to home.

How do I send money online to the Philippines?

It’s easy to start moving money to the Philippines online. Here’s how:

- Register and verify a free profile with Western Union. When you’re all set up, log in and click ‘Send now’.

- Select the Philippines in the destination box, followed by how much you want to send in US dollars.

- Click on ‘Bank account’, ‘Cash pickup’ or ‘Mobile wallet’ as the delivery method, and choose a payment option (credit card2, debit card or bank account).

- Carefully enter any information requested about your receiver, plus your payment details.

- Check your confirmation email for a tracking number. This allows you and your receiver in the Philippines to follow your transfer.

How much money can I send online to the Philippines?

You should be able to send up to $19,000 as a remittance to the Philippines. However, your personal daily limit will depend on the service you choose and your transfer history.

You can check your limit by registering with us and visiting your profile.

How much does it cost to transfer money to the Philippines?

Our price estimator tool will give you a good idea of how much it costs to send money to the Philippines. It shows you the transfer fees and exchange rates for different payment methods. We’ll also give you an estimate of how long your transfer might take to process.

How can I send money to mobile wallets in the Philippines?

You can send money to mobile wallets in the Philippines through our app, website or via an agent location near you. There are many options to choose from, but GCash is a popular mobile wallet app in the Philippines, and you can send your money directly from Western Union to a GCash account if the recipient has a fully registered profile.

You can check how to Send money to to a GCash account to learn more about transfers to the Philippines.

Still have questions?

Visit our FAQs or simply get in touch. Our Customer Care team is just a call away.

5 reasons to send money to a bank account with Western Union

Western Union makes it easy to send money transfers online to billions of bank accounts around the world. Why should you send with Western Union?

Here are the top 5 reasons.

* Terms and Conditions apply. Restrictions apply, see amazon.com/gc-legal

1 Real time transfers are available to Banco De Oro (BDO), Bank of the Philippine Islands (BPI), and Land Bank. For first-time BPI receivers, it may, however, take up to 2 hours. Funds sent to Land Bank between 10 am and 1 pm Eastern Time may also be delayed.

Funds may be delayed or services unavailable based on certain transaction conditions, including amount sent, destination country, currency availability, regulatory issues, identification requirements, Agent location hours, differences in time zones, or selection of delayed options. For mobile transactions funds will be paid to receiver’s mWallet account provider for credit to account tied to receiver’s mobile number. Additional third-party charges may apply, including SMS and account over-limit and cash-out fees. See the transfer form for restrictions.

2 Western Union makes money from currency exchange. Fees and rates subject to change without notice. Not valid on credit cards or transfers within the United States.

3 Network data as of June 30, 2020.

4 Funds will be paid to receiver’s mWallet account provider for credit to account tied to receiver’s mobile number. Additional third-party charges may apply, including SMS and account over-limit and cash-out fees. Funds availability subject to terms and conditions of service.

5 If you’re using a credit card, a card-issuer cash advance fee and associated interest charges may apply. To avoid these fees or for reduced fees, use a debit card or check other payment methods.

6 Please make sure that the receiver’s name accurately matches the details of the bank account owner. (Account details may vary by country.)

7 Fee reductions apply only to the Western Union® transfer fee for a single Western Union Money Transfer® or Quick Collect® transaction. Excludes all other services, including without limitation, online bill payments, and money transfers via social/chat applications. Points used will not be reversible and if amount of transfer fee is less than redeemed discount, no cash, credit or refund will be provided. Western Union reserves the right to offer promotions l discounts that cannot be combined with My WU® fee reductions.

8 Receiver charges may still be applied at select agent locations.