Send, spend, and receive money transfers with the Western Union Prepaid Visa® Card

Our fee waiver continues! $0 card purchase, $0 reload, and $0 per transaction fees now through April 30th, 2026.

*Other fees apply, see Cardholder Agreement for details.

Send money to Ecuador

{senderCurrencyName} to {receiverCurrencyName}

Register now to get better exchange rates and $0 fees on your first transfer*.

*FX gains apply. Not available for credit cards.

Convert {senderCurrencyCode} to {receiverCurrencyCode} with Western Union to send money internationally.

Check Rates

Fee: from {{strikedFee}} to {{fee}}

FX: 1.00 USD = from to

We encrypt your transfers.

We are committed to keeping your data secure.

Convenient ways to send and receive money

Ways to send money to Ecuador

Ways to receive money in Ecuador

Send online

Register for a free profile or log in to start sending money to Ecuador online. Move funds at home, work, or anywhere with an internet connection.

Send money online to EcuadorSend in person

Want to pay for your money transfer to Ecuador in cash? Visit one of thousands of agent locations across the US to send money in person.

Search Western Union locationsSend with our app

Send money to Ecuador from virtually anywhere with the Western Union® app. Save time at the counter by starting a money transfer on the app and completing at an agent location.

Download our appBank account

Transfer money to your loved one’s bank account in Ecuador for quick and convenient support. We work with many major banks in Ecuador.

Find out moreCash pickup

Arrange cash pickup at more than 4,9001 agent locations across Ecuador. Send money locally to agent locations in Quito, Guayaquil, Santo Domingo and more.

Find agent locations

Send money to our network in Ecuador

For 150 years, Western Union has been a leading global provider of fast and easy money transfers. Use our extensive network of payment service providers in Ecuador for seamless transactions. Whether to bank accounts or for cash pickup, enjoy reliable payouts.

Our featured payout partners in Ecuador include Banco Pichincha and Banco Guayaquil.

We also partner with many other trusted institutions, such as Banco del Pacifico, Produbanco, Cooperative Juventud Ecuatoriana Progresista, Cooperative Jardin Azuayo, and Banco del Austro. You can also find multiple cash pickup locations here.

Choose the way you pay

Using your bank details

With the Western Union Prepaid Visa® Card

Cash at an agent location

With a credit2 or debit card

Join us today

Refer your friends to Western Union and earn exciting rewards for every successful referral.

Easily send money to Ecuador

Cash payout

Bank account

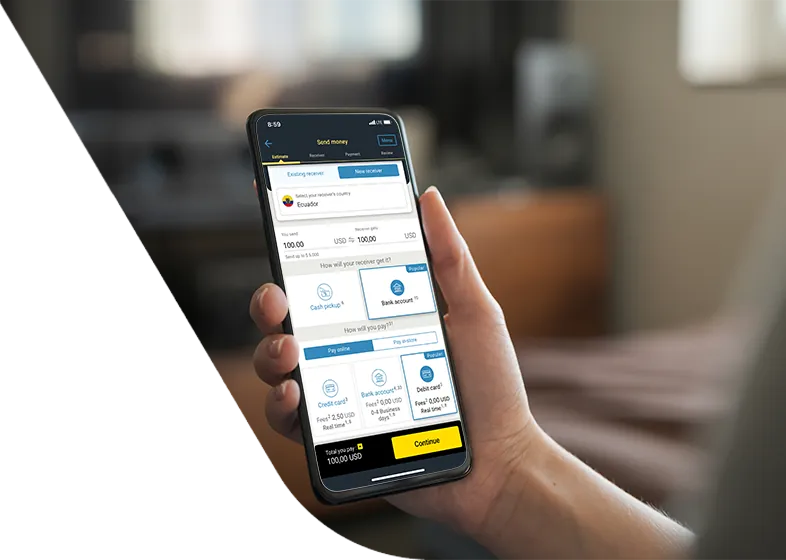

Send money to Ecuador in a few taps with our app

Send money to Ecuador on the go, at any time, from virtually anywhere.

Save your receiver’s details in Ecuador for fast future money transfers.

Track your transfer to Ecuador in the app.

More information on how to send money to Ecuador from the US

Move money to major banks

Send money straight to your friends and family’s bank accounts in Ecuador. Use Western Union® money transfer services to pay in cash or with a credit2/debit card when you don’t have a bank account in the US.

Send money to Ecuador fast

Transfer money to Ecuador for cash pickup at a convenient agent location and it can be ready in minutes3. Send to a bank account and it may take 0 to 4 days4.

Transfer money on the go

With the Western Union® app you can start sending money to Ecuador 24/7 from virtually anywhere. Arrange a money transfer on the way to work, at home or out and about.

Reasons to choose Western Union®

Convenient choice

When deciding how to send money to Ecuador, you can choose between sending money online, via our app, or in person. Pay with a bank account, cash or credit2/debit card.

Strong security commitment

We encrypt money transfers to Ecuador and any other country. Our fraud prevention efforts provide further peace of mind.

Local agent locations

Save time for your loved one by sending money for cash pickup at a nearby agent location in Ecuador. Support loved ones in Cuenca, Machala, Manta, Ambato and more with ease.

Sign up to send money to Ecuador today

Track your transfer

Use your unique tracking number (MTCN) to track your transfer as your money makes its way to Ecuador.

Register with ease

Get started in minutes as you register for free with just your name, email address and government-issued ID.

Schedule money transfers

Make sure your money arrives when it’s needed by arranging money transfers to Ecuador in advance and scheduling for specific days.

Frequently asked questions about sending money to Ecuador from the U.S.

How much money can I send to Ecuador?

You can send up to 5,000 USD to Ecuador – whether you transfer money to a bank account or for cash pickup, and no matter if you pay in cash, card, or bank transfer.

However, if you make a money transfer in cash, the maximum limit may vary depending on the agent location. Your money will be delivered as US dollars.

How do I send money online to Ecuador?

Understand how to send money to Ecuador online by following these steps:

- Log in or register for free and verify your profile.

- Click ‘Send now’ to start your online money transfer to Ecuador.

- Enter Ecuador as the destination and how much you want to send in USD.

- Select ‘Bank account’ or ‘Cash pickup’ as the receiving method. Input your receiver’s bank account information, their address, location, and other requested details, or select a previous receiver.

- Choose to pay with your credit2/debit card or by bank transfer to send the money.

- Check your email for a receipt with your unique tracking number (MTCN). Use and share this with your receiver to track the money transfer.

What do I need to send money online to Ecuador?

First you need either a US driver’s license, passport, or other form of government-issued ID to register for free. To send money to a bank account in Ecuador online you’ll then need your receiver’s:

- Full name

- Address

- Email address

- Phone number

- Bank account details – Bank name, account type, account number and cedula (ten characters)

- Money transfer purpose

If you send money online for cash pickup you need all of the above except for the bank account details.

How do I send money to Ecuador from a Western Union agent location?

Learn how to send money to Ecuador at an agent location with these simple steps:

- Find a Western Union agent location in the US near you.

- Head to a convenient agent location with your government-issued ID or phone number. Take these to the counter, as along with your receiver’s details, including bank account information if sending to a bank.

- Set up a money transfer to Ecuador and pay with cash or a US bank-issued debit card.

- Use your Money Transfer Control Number (MTCN) on your receipt to track your transfer. Share with your receiver so they know when to expect their money.

How do I estimate the cost to transfer money to Ecuador?

Simply use our price estimator to find out how much sending money to Ecuador could cost. Enter the amount you want to send, as well as your sending, receiving and payment method. Then you’ll see the total transfer amount, transfer fees4 and what your receiver gets – alongside estimated delivery times for transferring money to Ecuador.

Still have questions?

Visit our FAQs or simply get in touch. Our Customer Care team is just a call away.

Send money internationally

2 If you’re using a credit card, a card-issuer cash advance fee and associated interest charges may apply. To avoid these fees or for reduced fees, use a debit card or check other payment methods.

3 Funds may be delayed or services unavailable based on certain transaction conditions, including amount sent, destination country, currency availability, regulatory issues, identification requirements, agent location hours, differences in time zones, or selection of delayed options. For mobile transactions funds will be paid to the receiver’s mWallet account provider for credit to the account tied to the receiver’s mobile number. Additional third-party charges may apply, including SMS and account over-limit and cash-out fees. See the transfer form for restrictions.

4 Real Time money transfers are available when sending money to Banco Pichincha account holders in Ecuador. Date available will be displayed on receipt for international transfers over $15. Service and funds may be delayed or unavailable depending on certain factors including the Service selected, the selection of delayed delivery options, special terms applicable to each Service, amount sent, destination country, currency availability, regulatory issues, consumer protection issues, identification requirements, delivery restrictions, agent location hours, and differences in time zones (collectively, “Restrictions”). Additional restrictions may apply; see our terms and conditions for details. Excludes receiver’s bank holidays.

5 Western Union makes money from currency exchange. Fees and rates subject to change without notice. Not valid on credit cards or transfers within the United States.